SaaS is booming: more software enters the market every day and businesses are ready to buy, buy, buy!

But companies already have too much software to manage. With more than 100 SaaS products purchased per organization, SaaS subscriptions can easily fall through the cracks. If that happens, do you really want to lose money because your customer forgets to renew their subscription and you don’t have automatic payments in place?

Today, we are going to cover exactly these kinds of challenges faced by software as a service businesses reliant on subscription business models.

Many companies adopt subscription business models without considering alternatives. This makes sense. After all, subscriptions offer many benefits for both you and your customers.

But this isn’t the full picture.

Subscriptions have flaws and can hurt your business by:

- Reducing upfront revenue and cash flow

- Increasing churn rates

- Skyrocketing customer acquisition costs.

These negative effects are real, but your subscription management provider won’t tell you about the money you’re leaving on the table. So let’s break the silence.

In this post, we will explore 6 reasons why your SaaS business should ditch subscription pricing before it’s too late.

Yes, Subscriptions Have Benefits

Let’s start by acknowledging some benefits.

After all, most SaaS solutions charge their customers via subscriptions for a reason. Subscriptions are popular with business buyers while granting sellers predictable revenue. So let’s briefly discuss some strengths of this model.

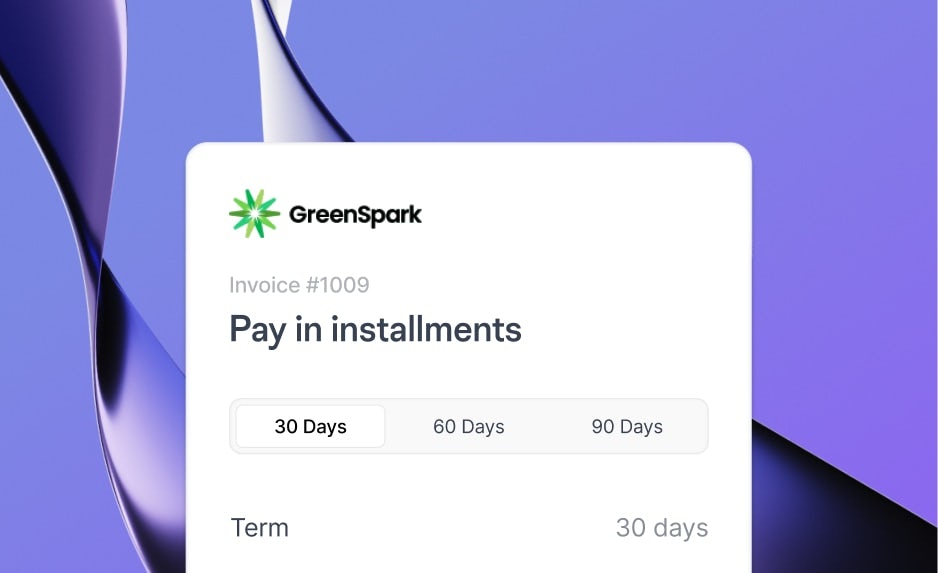

Increase Sales with Flexible Payment Options

Subscriptions provide flexibility.

Business buyers enjoy paying in smaller installments. Large upfront purchases have flaws, while small payments:

- Allow credit card payments

- Reduce perceived cost

- Focus on product value.

With installments, customers can better fit the product costs into their budget.

Expand TAM (Total Addressable Market) by Capturing Smaller Businesses

Subscriptions make your product accessible to customers who wouldn’t buy otherwise.

Smaller businesses often struggle to justify large upfront payments. To get them on board, you have to either discount your product or split up the payment into installments. If you use subscriptions to divide the bill, you can access additional market segments and grow your ARR (annual recurring revenue).

Establishing a relationship with young businesses can also benefit you in the long term, since you can capture small companies before they become big.

Shorten Sales Cycles with Lower Cost of Entry

Even more established organizations may hesitate in front of a large initial bill.

This hesitation sucks money directly out of your business. Every day of negotiations raises your CAC (Customer Acquisition Cost). Long sales cycles:

- Hurt cash flow

- Exhaust your sales team

- Waste your customers’ time.

On the other hand, customers view subscriptions as cheaper compared to their monthly revenue, easing their purchasing decision.

Given these benefits, why are we saying that subscriptions are a mistake?

Subscription business models have flaws. Below, we outline 6 main reasons why you should stop charging your customers for your SaaS products through subscriptions. These reasons are split into two key categories:

- Costs of subscriptions to your SaaS business

- Customer grievances with software subscriptions

Let’s dive in.

Subscriptions are Costing Your SaaS Business Time and Money

Your subscription model is draining money from your SaaS business.

First, predictable revenue remains predictable only when everything goes according to plan. But your SaaS products are vulnerable to payment issues. Second, to manage subscriptions, your business has to invest capital and employee time into handling reconciliation, invoicing, and cash flow gaps.

As a result, you’re losing money and are too tired to even notice.

1. You Take on All the Risk

When you charge customers in installments, you’re depending on the process to work as expected.

But what if a customer doesn’t pay? Nearly half of customers churn because of credit card failures (delinquencies). In addition, your customer might forget to pay an invoice on time. If you don’t have an automatic payments and invoicing process in place, then there is no time efficient path to stay on top of this. On top of this, even if there are no payment issues, your customer can simply cancel their plan.

Whatever may go wrong, your business is forced to carry the risk.

2. You Spend More on Invoicing and Reconciliation

With or without payment issues, successfully managing subscriptions takes time.

Your team has to:

- Prepare invoices

- Handle payment methods

- Process transactions

- Ensure compliance with regulations.

If customers forget to pay, you need to send them reminders until they do. If you offer discounts or allow for customized plans, all payments must correspond to the terms of those deals so all customers pay what they owe.

These responsibilities quickly compound as you scale, potentially leading you to purchase expensive external software just to manage customer subscriptions.

3. You Suffer from Cash Flow Gaps

Even when all payments are processed, your team still has more work to do.

Partial payments inevitably hurt your cash flow. After all, when a customer pays upfront, you capture the full value of their plan at once. If that customer pays in 12 installments, you only see 1/12th of their plan value in your bank account at a time. Delayed revenue can easily hurt your business, especially as you scale. As you close more customers, your costs immediately go up to accommodate those users. But your revenue will take multiple months to catch up, potentially sending your finances into the red.

Because of these factors, financial projections become difficult and your business suffers.

Customers are Unhappy with SaaS Subscriptions Too

But even if subscriptions mean a lot more work and risks for your business, they must be worth the customer satisfaction, right?

Wrong. Business buyers often don’t like paying for subscriptions. Minor annoyances build up over time as customers have to handle more SaaS products.

Your business bears that burden too.

4. Customers Expect More from Subscription Plans

When customers pay the same amount of money for a service, they naturally expect its value to increase.

Let’s consider a hypothetical scenario:

- James Green, the CEO of a growing medical diagnostics platform called Green MedTech, buys a CRM (Customer Relationship Management) subscription for $2,000/month.

- In the first month of using the CRM, Green MedTech sees a significant reduction in their costs and time spent on maintaining customer records.

- By month six, James checks in on the company’s finances and notices that customer management costs have stalled.

- James feels that his CRM solution is not worth $2,000/month anymore, given that Green MedTech is not experiencing clear benefits month to month.

- Green MedTech switches to a different CRM with more features at a lower price.

The perceived value of a product will naturally go down over time, so to maintain customer expectations you have to keep improving your SaaS solutions with new features, bug fixes, or deals.

5. Customers Frequently Cancel Their Subscriptions

As competition in the SaaS space grows more fierce, you can’t afford to lose business because of subscription-related complaints.

Business buyers are notoriously picky. Two-thirds of B2B buyers in 2022 are ready to “actively look” for another provider if they are unhappy with pricing alone. And subscription products attract disproportionately large amounts of customer support inquiries from business and consumer buyers alike. If your company isn’t ready to accept large volumes of cancellation requests, it will suffer. Nearly all consumers don’t want to buy from a company again if they have a hard time canceling their subscription.

To keep your buyers happy and your company reputation intact, you will have to keep investing more and more resources into customer satisfaction. Understanding these key business model mechanics is critical to the ongoing success of your business.

6. Customers Churn More Often

Since customers expect more from your product and are easily spooked into canceling their plan, short billing cycles are equivalent to shooting your business in the foot.

If you charge annually, your customers only have 1 purchasing decision to make that year. If you charge per month, then your customers have 12 separate purchasing decisions a year. Every month you make your business vulnerable to cancellations and churn.

In fact, companies that charge most customers monthly have double the rate of customer churn compared to those companies that charge annually.

What Can You Do?

Subscriptions are draining your resources, enforcing unhealthy customer expectations, and increasing customer churn. There are 6 main reasons to dump your subscription business model before it kills your company. With subscription pricing:

- You take on all the risk.

- You spend more time on invoicing and reconciliation.

- You suffer from cash flow gaps.

- Customers expect more from subscriptions.

- Customers frequently cancel their subscriptions.

- Customers churn more often.

Your Competition is Investing In Alternative Pricing Strategies

While subscriptions may seem like the only way to charge for SaaS, the industry is changing.

Best-performing companies across all B2B segments stand out by investing more into their pricing strategies and methods. Alternative pricing models are popping up in the software space as more businesses realize the flaws of old-school models like upfront or subscription-based billing. With new options like BNPL (Buy-Now-Pay-Later) and automatic payments offerings for B2B products, you can combine the flexibility of subscriptions with the benefits of charging in full. We implore you to check out our FAQ page to better understand our unique flexible price offering method.

If you’re ready to see how much decreasing your sales cycle and increasing your ACV (average contract value) can grow your revenue, you can try out our ARR Growth Calculator.