Managing payment acceptance and accounts receivable efficiently is business critical. Organizations with multiple divisions, segments, and locations face unique challenges in maintaining financial control and understanding the intricacies of diverse revenue streams. We’ll explore the significance of effective management in this realm and how leveraging advanced platforms, such as Alternative Payment’s team functionality, can be a game-changer for businesses seeking success in a complex environment and to manage their accounts receivable billing more closely.

Complexity of Managing Multiple Divisions, Segments, and Locations:

Companies operating across various divisions, segments, and locations often find themselves grappling with the complexities of payment acceptance and accounts receivable management. Each entity may have distinct payment processes, invoicing structures, and financial reporting needs, making it a daunting task to maintain uniformity and transparency across the organization. Traditional methods of managing these aspects are not only time-consuming but also prone to errors, leading to potential financial discrepancies.

Alternative Payment’s Team Functionality:

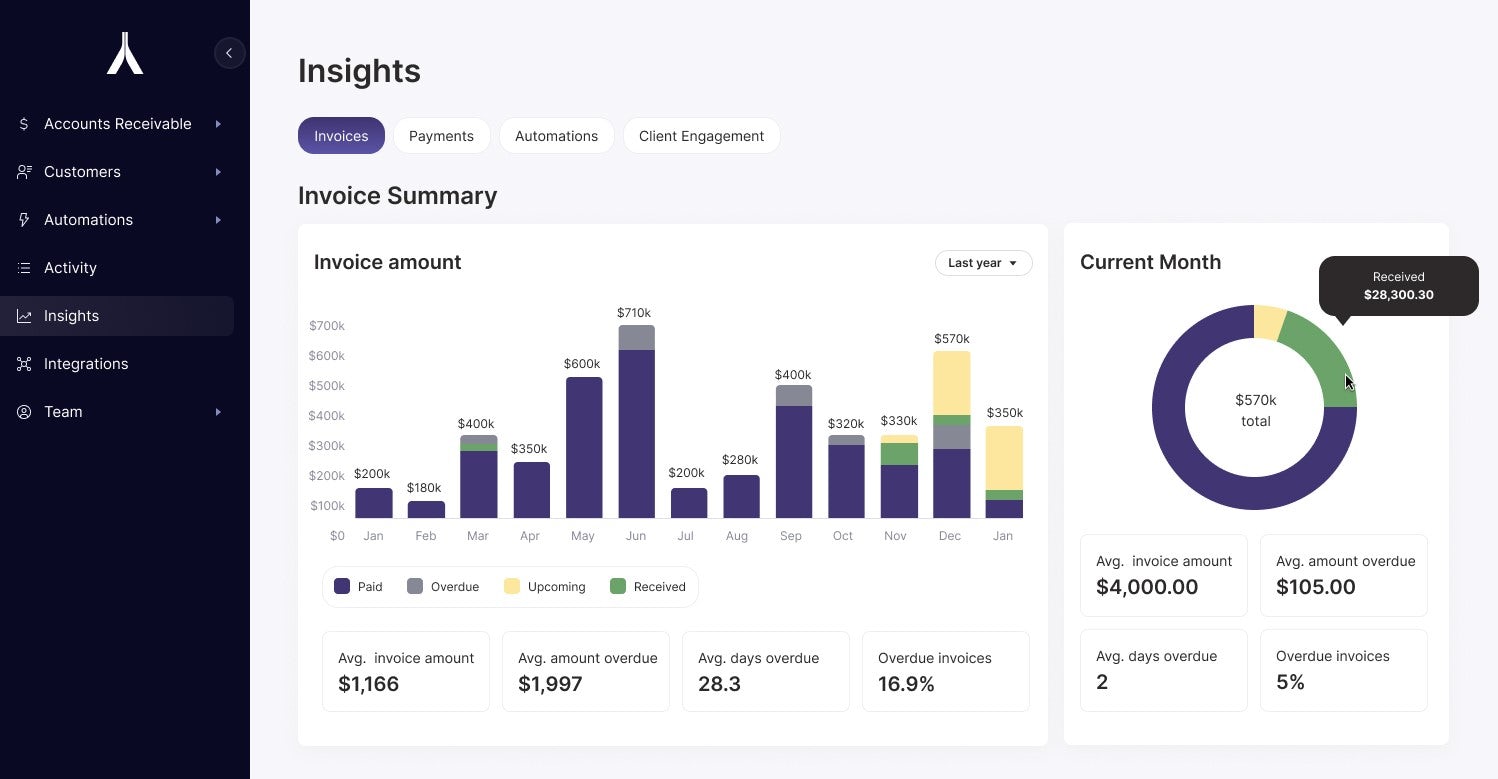

Alternative Payment’s team functionality offers a unique solution to the challenges associated with managing payment acceptance and accounts receivable in a multi-faceted business environment. The platform introduces a multi-tenant environment, providing the flexibility that companies operating in different sectors or locations desperately need. The platform offers numerous key features and benefits:

Centralized Control:

One of the standout features of the team functionality is its ability to offer centralized control over payment acceptance and accounts receivable. This empowers businesses to maintain a bird’s eye view of their financial operations, facilitating better decision-making and strategic planning.

Customizable for Diverse Industries:

Accounting firms and Managed Service Providers (MSPs) often operate in diverse industries with unique financial requirements. The team functionality allows for customization to suit the specific needs of various sectors, ensuring that each division or segment operates seamlessly within the same framework.

Location-Specific Insights:

For businesses with multiple locations, gaining insights into the financial performance of each site is crucial. Alternative Payment’s platform provides location-specific reporting, allowing organizations to understand the unique dynamics and challenges faced by different branches.

Enhanced Security Measures:

Security is paramount in financial transactions, especially when dealing with diverse payment methods and locations. Alternative Payment’s team functionality incorporates advanced security measures to safeguard sensitive financial information and prevent unauthorized access to certain employees or other users.

Scalability and Adaptability:

As businesses grow and evolve, the need for scalable solutions becomes inevitable. The platform’s scalability ensures that it can adapt to the changing needs of an organization, whether it’s expanding into new markets or diversifying its service offerings.

Effective management of payment acceptance and accounts receivable across various divisions, segments, and locations is undeniably business critical. The team functionality offered by Alternative Payment emerges as a groundbreaking solution, providing the flexibility, control, and adaptability necessary for success in today’s complex business landscape. As organizations continue to navigate diverse markets, having a platform that streamlines financial processes can be a defining factor in achieving sustained growth and profitability.