Of all the tools in your accounts receivable tool kit, leveraging automation capabilities can be the one that tackles both an internal bandwidth crunch and the unfortunate tedious push that is often required to get your invoices paid. And yet, many organizations continue to lean into the manual billing practices that they have long used at the risk of wasting precious time and leaving money on the table. According to Alternative Payments B2B Payments Trends Report, 30% of business invoices are 90 days past due.

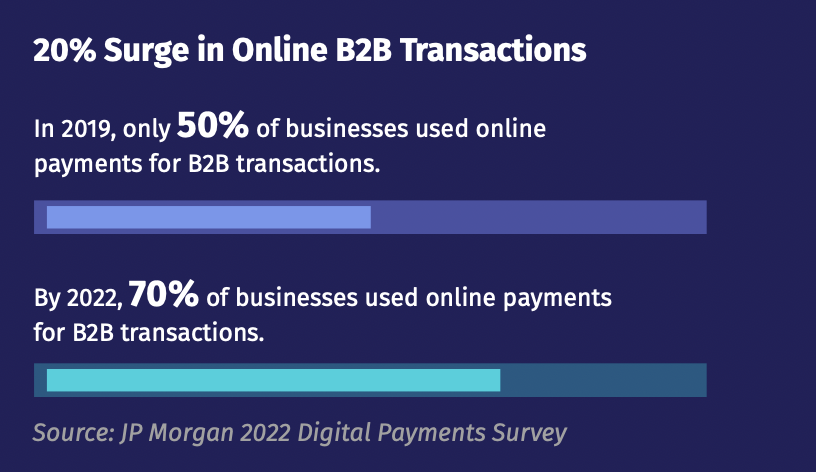

The good news is, automated payments have increased in popularity due to the time savings for both companies and their customers, as well as the cash flow improvement for companies. In short, AR automation is the future of invoicing and payments. It’s essential for businesses to learn more about it and better understand how to implement it and lean into the value of it for their business.

What is Accounts Receivable (AR) Automation?

At its core, accounts receivable automation refers to the utilization of advanced software solutions and technologies to streamline the invoicing, billing, and collection processes associated with receivables management. By leveraging automation, businesses can automate repetitive and time consuming tasks, standardize workflows, and gain real-time insights into their receivables. As a result they have the ability to enhance their operational and financial efficiency.

The Importance of AR Automation for B2B Companies

Despite the majority of B2B companies having robust payment processes with a variety of moving pieces, and many transactions, many of their payments processes continue to be manual. Invoices are slow to be paid, and overall the cash flow process slows. Accounts receivable automation can be instrumental in modernizing outdated billing practices, and helping organizations to more efficiently use their time. AR automation can help to address and tackle the following:

Streamlined Invoicing and Billing: With automation, B2B companies can generate and dispatch invoices promptly, ensuring accuracy and consistency across all transactions. By automating the invoicing process, businesses can minimize delays and disputes, leading to faster payment cycles and improved cash flows.

Enhanced Cash Flow Management: By automating receivables processes, B2B companies can gain greater visibility into their cash flow dynamics, allowing them to anticipate liquidity needs, optimize working capital, and make informed financial decisions. With automated reminders and follow-ups, businesses can also expedite collections and reduce the incidence of late payments.

Efficiency and Cost Savings: Automation eliminates the need for manual intervention in receivables management, thereby reducing the likelihood of errors, delays, and resource inefficiencies. By automating routine tasks such as data entry, reconciliation, and reporting, businesses can allocate their human capital to more strategic activities, driving productivity and cost savings in the long run.

Key Challenges that Accounts Receivable Automation Solves

In the realm of accounts receivable management, several challenges have traditionally plagued businesses, including:

- Manual Data Entry: Traditional receivables processes are often marred by manual data entry errors, leading to inaccuracies in invoices, billing discrepancies, delays in payment reconciliation, and a slow down in overall cash flow.

- Invoice Disputes and Delays: Without automated systems in place, businesses struggle to track invoice statuses, resolve disputes, and ensure timely payments from customers, leading to prolonged payment cycles.

- Limited Visibility and Reporting: Manual receivables processes lack the real-time visibility and reporting capabilities needed to monitor key metrics, identify trends, and drive strategic decision-making within the organization.

- Resource Intensiveness: Manual receivables management consumes valuable time and resources. Billing, accounts receivable, and collections teams save hours a week through automations – included and not limited to email, reminders, follow ups, auto-pay, and many others.

Case Study: How leveraging AR automation lead to 50% faster collection time for Heiden Technology

For organizations that have prioritized accounts receivable automation capabilities, the payoff is invaluable. Heiden Technology, a managed service company, wanted to simplify their payment process for customers while automating manual tasks and getting paid quicker. Like most organizations, their accounts receivable ecosystem was rooted in manual processes and timely as a result. Prior to leveraging any automation, 100% of payments were done via check or over the phone, which greatly impacted the speed of their cash flow.

By using an accounts receivable automation solution with Alternative Payments Automation feature, they significantly upgraded their payment process. This included:

- Simplified customer payments with Alternative’s payment portal

- Multiple hours saved each week by automating payments and transaction reconciliation

- Payment collection times 29 days quicker than industry average

At the end of the day they were able to have a 50% faster collection time in using AR automation and moving away from their manual billing process. It’s clear that leaning into automation capabilities for businesses is crucial, and can quickly save them time and money.

How do I know if accounts receivable automation is right for my business?

Accounts receivables look different for every organization. The challenges for some may not be the same for others. It’s important to evaluate your current payment processing infrastructure, and your accounts receivable processes today to understand if your organization could benefit from leveraging automation in your processes.

At its core AR automation provides a path to optimize and modernize outdated billing and invoicing practices, alleviate internal bandwidth, and ultimately expedite the transaction and cash flow process. Most organizations today could benefit from improving any of these core pieces of the account receivable process.

For those ready to take the next steps, Alternative Payments Automations is helping businesses to make payments and accounts receivable a breeze.

- Skip manual work: Forget paper invoices and manual data entry. Use our AR automation software to do all the work for you and save countless hours.

- Improve collection rates: Set up simple auto-pay rules to reduce collection times and eliminate the problem of overdue collections.

- Grow your revenue: Free up your time and resources to focus on everything else, like growing your business and increasing numbers.

Alternative Payments Automations makes automating your accounts receivable processes a breeze with key features like auto-pay.

With auto-pay and auto-reconciliation features, Alternative Payments is equipping businesses with a complete suite of accounts receivable features that simplify payments and unlock instant cash flow. Recently onboarded companies experience 26% payment automation the month they onboard, ramping up to 41% by month 6 due to process adjustments, education, and time investment for businesses and their customers.

In conclusion, accounts receivable automation is quickly becoming essential for B2B brands seeking efficiency, accuracy, and growth in their payments process. By embracing automation in receivables management, businesses can put themselves ahead of the curve, free up internal bandwidth, save time and money, and ready themselves for the demands of the modern B2B landscape.

Ready to make the shift towards automation today? Learn more about Alternative Payments Automations feature.